What’s the hold up?

SHAREHOLDER THEORY

A vast majority of businesses still swear by Milton Friedman’s Shareholder Theory and focus solely on increasing profits, neglecting the environment and the society.

As a result, linear “take, make, waste” business models prevail.

Economic Impact

Three billion middle-class consumers are expected to enter the global market by 2030 (Figure 1), driving unprecedented demand for goods and services. Global energy consumption is projected to continue to increase (Figure 2). Without a rethink of how we use our resources, fossil fuels can be depleted within fifty years (Figure 3). Growing resource scarcity is reflected in rising, volatile energy and commodity prices (Figure 4).

Social Impact

Since 1979 the gap between productivity and a typical worker’s compensation has increased significantly (Figure 5). Companies concerned purely with short-term shareholder value managed to enjoy high levels of productivity and endure high employee turnover for the past four decades thanks to declining union membership rates (Figure 6). But as the gap between executive salaries and worker pay expands, more people are becoming discontent and go on strikes (Figure 7).

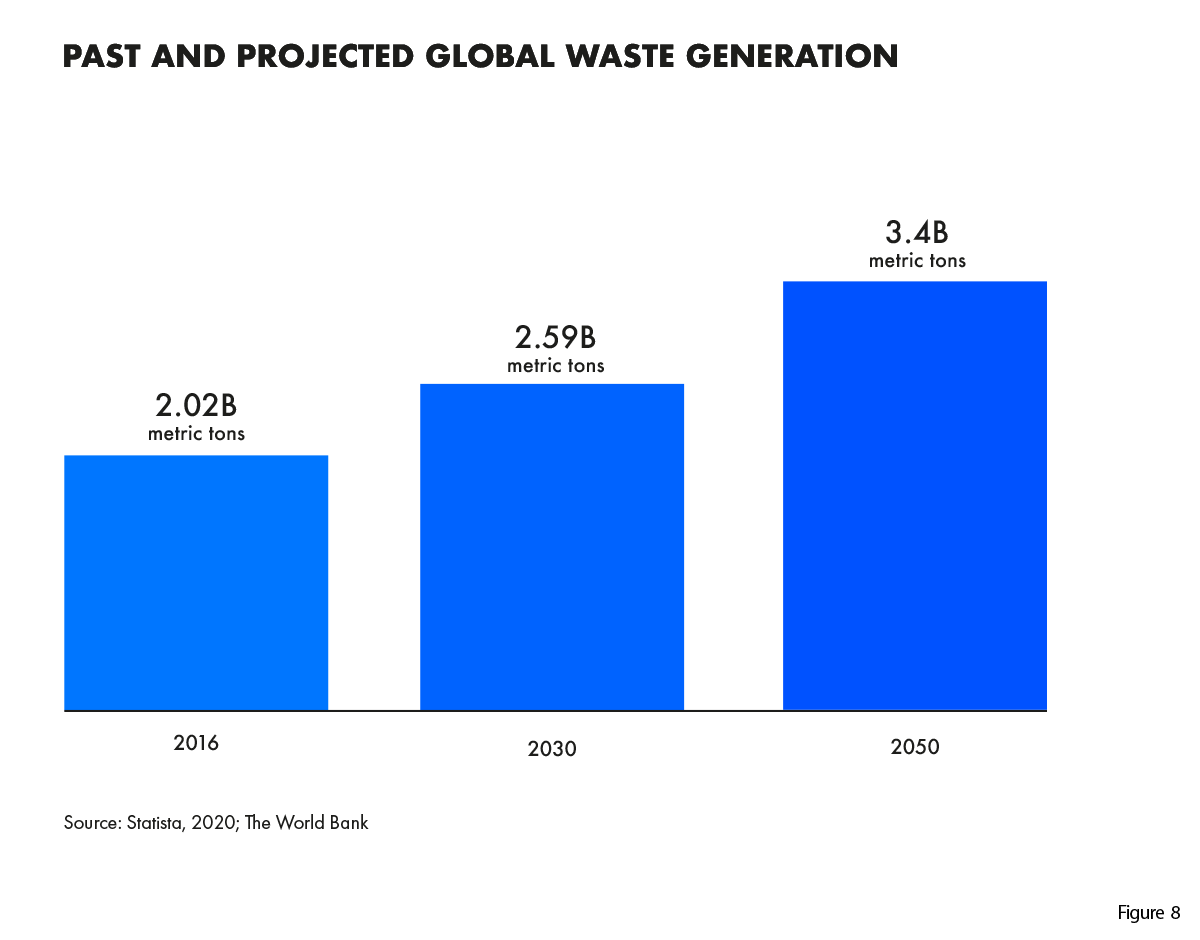

Environmental Impact

Profit-above-all mentality has resulted in linear ‘take, make, waste’ economy where value is created by producing and selling as many products as possible. This continuous cycle of production and consumption comes at a cost. The World Bank warns that global waste will increase up to 70% on current levels by 2050 (Figure 8). The rising levels of CO2 emissions contribute to global warming (Figure 9) and result in more frequent climate-related disasters that are wildly expensive (Figure 10).

Impact on Reputation

ESG (Environmental, Social, and Governance) score refers to the three central factors in measuring the sustainability and societal impact of an investment in a company. The higher the ESG score of the company the more positively it is received by the market (Figure 11). Having a clear brand purpose (a reason for being beyond making money) also accelerates the growth of brand equity, the factor that predisposes a consumer to purchase a particular brand, or to pay more for it, or both (Figure 12). Profit-above-all businesses score low on both accounts.

What’s the solution?

TRIPLE BOTTOM LINE THEORY

The surest way to future-proof a business and to answer the growing demand is to follow John Elkington’s Triple Bottom Line Theory and become a financially, environmentally and socially responsible company (B-Corp).

As a result, circular ’take, make, recycle’ business models will prevail.

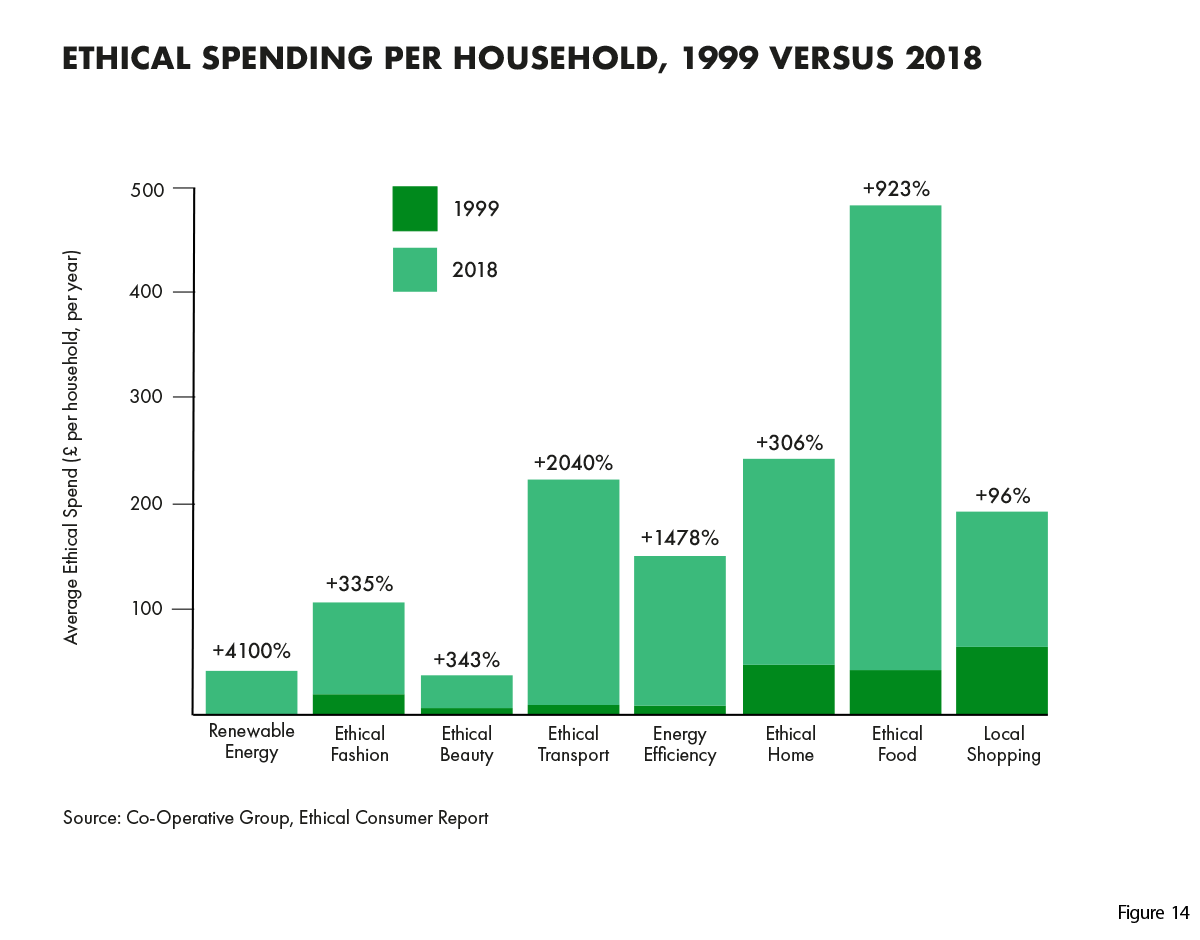

Economic Impact

Circular business models are based on closed-loop systems. The products, components and materials are kept at their highest utility and value – reducing the need for extracting and processing new resources. Net material cost savings, globally, amount to as much as US$ 700 billion per annum (Figure 13). Total ethical consumer spending has risen almost fourfold in the past 20 years and has now swelled to over £41 billion (Figure 14) and sustainable debt sees record issuance at $465bn in 2019 (Figure 15). What is more, the growth of sustainable businesses surpass the national economic growth (Figure 16).

Social Impact

Ethical businesses report improved reputation, better employee motivation and retention (Figure 17). According to a recent study by Harvard, 35 to 74:1 CEO-to-worker pay ratio is the most favourable in terms of ROI (Figure 18).

Environmental Impact

The initial goal of the circular economy is to decouple economic growth from resource use, i.e. to improve the rate of resource productivity (“doing more with less”) faster than the economic growth rate (Figure 19). The economy can grow, without using more resources and exacerbating environmental problems (Figure 20). It is vital to remember that the ecosystem services we tend to take for granted constitute the foundation upon which both our society and the economy stand (Figure 21).

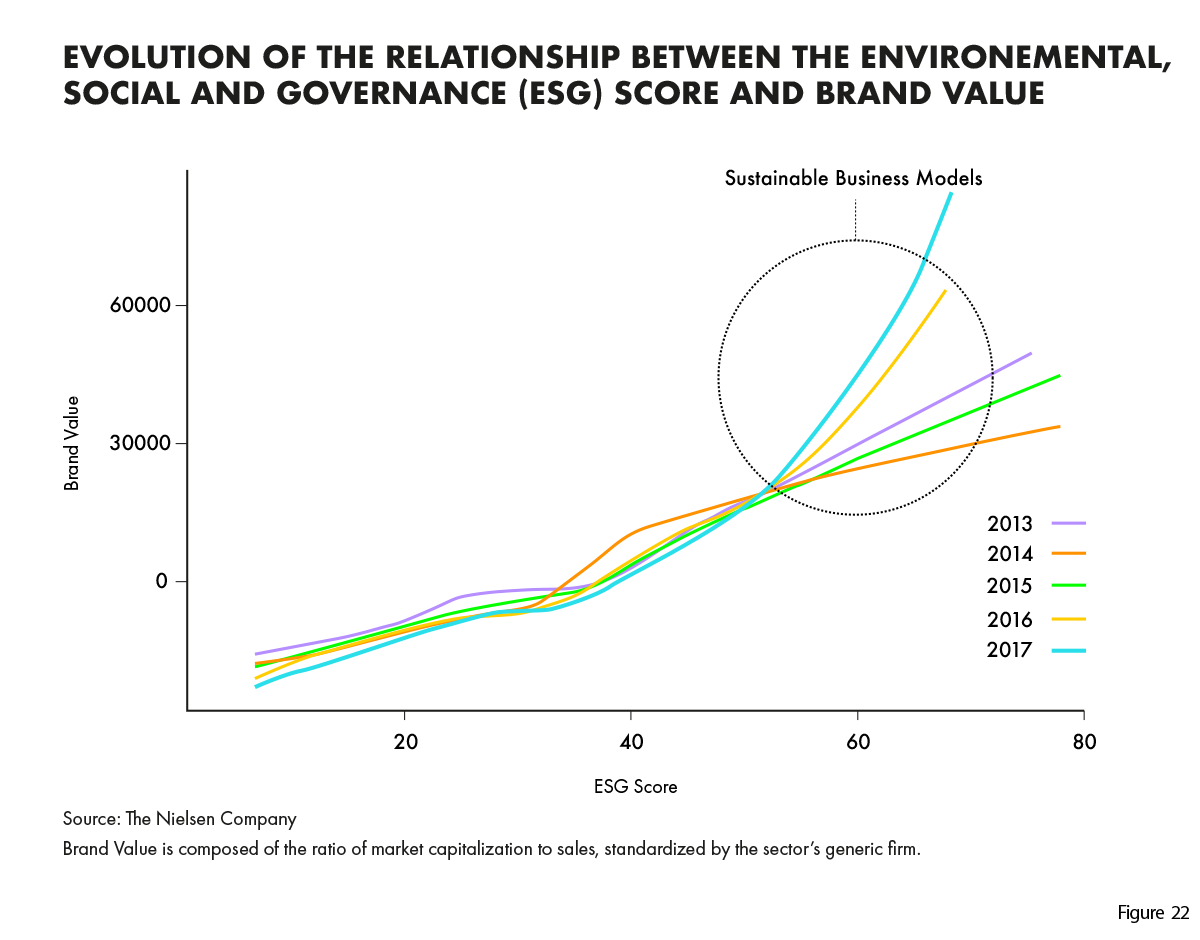

Impact on Reputation

ESG (Environmental, Social, and Governance) score refers to the three central factors in measuring the sustainability and societal impact of an investment in a company. The higher the ESG score of the company the more positively it is received by the market (Figure 22). Having a clear brand purpose (a reason for being beyond making money) also accelerates the growth of brand equity, the factor that predisposes a consumer to purchase a particular brand, or to pay more for it, or both (Figure 23). Sustainable businesses score high on both accounts.